Selecting a “safe” stock with a solid dividend is quite popular in the current economic climate. The traditional “safe” investments are paying extremely low interest rates while many American companies are growing revenues while paying out strong dividend yields (4% and higher) that exceed those of government bonds. In late December, I selected a set of stocks with solid financial strength ratings, positive revenue growth in the past year, dividends of 4% or more and lower than average stock price volatility (also called the beta of a stock.)

Selecting a “safe” stock with a solid dividend is quite popular in the current economic climate. The traditional “safe” investments are paying extremely low interest rates while many American companies are growing revenues while paying out strong dividend yields (4% and higher) that exceed those of government bonds. In late December, I selected a set of stocks with solid financial strength ratings, positive revenue growth in the past year, dividends of 4% or more and lower than average stock price volatility (also called the beta of a stock.)

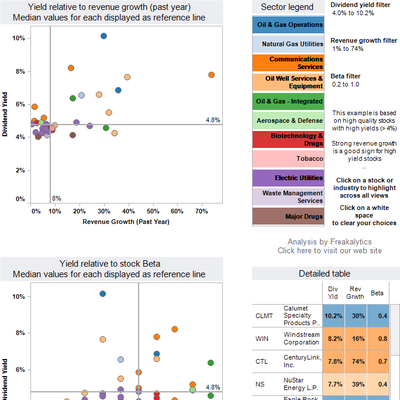

After some data cleanup, I assembled this into a dashboard for quick review and exploration. This dashboard allows you to select higher yields, higher revenue growth or lower levels of volatility. By clicking on an individual stock, you are taken to MSN Money web site (below initial dashboard) for their current “StockScouter” rating.

This data includes many estimates and extrapolations based on work by Freakalytics. This is not a stock solicitation. We are not investment advisers. All information presented here is for your review and consideration. You should consult and understand the filings at www.sec.gov before buying any stock. No claims are made as to accuracy of this data or analysis for investment purposes. Consult your financial adviser, properly registered and licensed in your location, before making any investment decisions.

Securely share R shiny apps

Develop R shiny apps

All on one dedicated, secure and powerful platform.