LinkedIn, undervalued and underloved?

After examination of the data against peers, I believe LinkedIn is priced for great growth potential in the coming years. Don’t get me wrong, it’s an IPO and they can be very volatile. However, I prefer to make my investments in companies based on long-term outlook rather than speculate on short-term trading gains.

It is estimated that LinkedIn (NYSE: LNKD) will price at $42-$45 per share tomorrow, valuing the company at $4.1B which implies approximately 94.5M shares in float. Based on revenue over the past 4 quarters, this values LinkedIn at 14.1 times revenue (Price/Sales). Meanwhile, Facebook is valued at ~ 30 times revenue and Salesforce is priced at 10.5 times current year revenue. Examining the growth in revenue and trajectory of revenue growth, our estimates are that LNKD will be at ~ 8 times forward P/S at the end of 2011 and ~ 4 times forward P/S at the end of 2012 (based on the IPO pricing.) I find this amazing given the difficulty of another company encroaching upon LinkedIn’s 100M plus members and considering the many new revenue opportunities that await LinkedIn. One last interesting metric is per member valuation, LNKD is valued at ~$40/member while Facebook is valued at ~ $140/member (Facebook, $70B estimated value with ~ 500M active users.)

Now, I am not sure of what you think of LinkedIn, but I know companies and recruiters seeking the best employees LOVE it. In fact, many companies will pay bounties of $3,000-$30,000 per new employee to headhunters as the economy picks up. If LinkedIn captures just a few percent of this money, you can see how each member may be worth hundreds of dollars from just this one area, assuming people switch careers every 3-5 years. This doesn’t include their ad platform, their jobs platform, their ever-growing groups platform (where you actually know who you are talking with), their premium search and a multitude of media/shopping opportunities with magazines, newspapers and other e-commerce brands.

While Facebook gets all the love, I believe that LinkedIn has built a nearly impenetrable “moat”, preventing serious competitors for years to come. Don’t get me wrong, I don’t hate Facebook, I just think they have an easier moat to cross than LinkedIn. This is due to the fact that one’s personal life can easily be posted on another website in a matter of minutes, but entering all of your career contacts, jobs, descriptions, LinkedIn recommendations and more is a real pain.

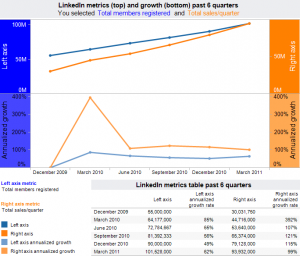

Feel free to examine the growth of LinkedIn across various metrics over the past six quarters with this interactive dashboard. Data harvested and estimated based on their IPO filings, Google Finance and Facebook.com.

This data includes many estimates and extrapolations based on work by Freakalytics. This is not a stock solicitation. We are not investment advisers. All information presented here is for your review and consideration. You should consult and understand the filings at www.sec.gov before buying any stock, especially an IPO. We currently have no holdings in LinkedIn but plan to purchase shares after the first few days of public trading. We currently use LinkedIn as an advertising platform, with modest monthly spend. Additionally, Stephen at Freakalytics used to work indirectly for Leslie Kilgore at Netflix who is currently on the Board of Directors of LinkedIn. Freakalytics currently has no business plans or agreements with Leslie, LinkedIn or Netflix. No claims are made as to accuracy of this data or analysis for investment purposes. Consult your financial adviser, properly registered and licensed in your location, before making any investment decisions.

See the recent filing data that much of this analysis is based on here.

Freakalytics

This is brought to you by the leading independent Tableau training source, Freakalytics. We offer training focused on solving real-world problems with your data, Tableau and other relevant analytic tools and technologies. Please contact us if we can be of service with on-site training at Info@Freakalytics.com

Freakalytics has trained thousands in public and on-site classes around the world, including founding and authoring Tableau’s training program back in 2009, writing the first Tableau book (now in the 4th edition), teaching at multiple Tableau world and European conferences and direct leadership roles at Tableau with the founders, guiding the future of Tableau Desktop. We are also the authors of The Accidental Analyst, SAS for Dummies, The Rapid Dashboard Reference Card and have been on the faculty of The American Marketing Association and The Data Warehouse Institute.